ENVIRONMENT (E)

Policy

We will contribute to environmental conservation through the provision of IT services, as well as work to improve the efficiency of resource utilization and reduce the environmental impact of our business activities in order to make a decarbonized society a reality.

Tackling Climate Change

The System Support Group is implementing activities to reduce CO₂ emissions through the use of renewable energy and other means. We are also working to improve our disclosure system and CDP score in line with TCFD.

TCFD Disclosures

Governance

The System Support Group has established a Sustainability Committee, chaired by the President and Representative Director, to consider and implement measures concerning sustainability. It meets in principle once every six months.

The Committee plans, examines, and formulates measures related to sustainability, including measures to address climate change, and promotes activities to realize the Basic Sustainability Policy. The activities of the Committee are reported to the Board of Directors, which provides supervision and guidance for the realization of the Basic Sustainability Policy.

During the fiscal year ended June 30, 2025, the Committee met twice to discuss the topics outlined below. It also reported to the Board of Directors twice.

*Activities prior to 2024 are those undertaken by the Sustainability Committee established at System Support Inc.

| Month Held | Topics of Discussion |

|---|---|

|

November 2024 |

|

|

May 2025 |

|

Strategy

Our Group considers climate change action to be a vital business priority, essential for our sustainable growth. To understand the impact of climate change on our business, we have conducted a scenario analysis based on the recommendations of the TCFD. Through this process, we have identified climate-related risks and opportunities and are striving to strengthen our business resilience. At the same time, we are working to reduce our environmental impact to contribute to the sustainable development of society.

i. Overview of Scenario Analysis

Based on reports from the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), we have selected two climate scenarios for our analysis: a 1.5°C and a 4°C global temperature rise by the end of the century over pre-industrial levels. We have analyzed and assessed the business impact of transition risks and opportunities under the 1.5°C scenario, and of physical risks under the 4°C scenario.

ii. Identification and Assessment of Risks and Opportunities

| Category of Risk/Opportunity | Time Horizon※1 | Impact from Climate Change | Impact Level※2 | Response Plan | ||

|---|---|---|---|---|---|---|

| Risk | Transition | Regulatory/Policy | Short- to Medium-term | Introducing a carbon tax will raise our operating costs by creating new charges based on our emissions. Furthermore, we expect suppliers to pass on their own increased costs through higher procurement prices. | Low |

|

| Medium- to Long-term | Growing demand for carbon offsets to meet emissions targets will push credit prices higher, making it more expensive to reduce emissions. | Low |

|

|||

| Short- to Medium-term | Stricter GHG emissions reporting obligations will mean a broader scope, more frequent reporting, and increased verification. This will add to our operational workload and increase operating costs. | Low |

|

|||

| Medium-term | Stricter energy conservation laws will require office tenants to upgrade to more efficient equipment and adopt better energy management practices, increasing their capital investment. | Low |

|

|||

| Medium- to Long-term | We face the risk of shareholder lawsuits if we fail to disclose critical climate information or provide false reports. Being held legally liable in such cases would result in significant response costs. | Low |

|

|||

| Technology | Medium- to Long-term | Keeping pace with advancements in decarbonization technology and the acceleration of DX will require greater investment in R&D as well as in securing and developing talent. | Low |

|

||

| Medium- to Long-term | With growing customer demand for energy-saving and decarbonization solutions, we risk losing business if we don't invest adequately in service development or if we fall behind schedule. | Low |

|

|||

| Market Competitiveness | Medium- to Long-term | Tighter regulations on energy use and a growing share of renewables will drive up our electricity procurement costs. We also anticipate that suppliers will pass on their own cost increases to us. | Low |

|

||

| Medium- to Long-term | Policies promoting Zero-Energy Buildings (ZEB) will drive up demand for green office spaces, causing office rents to rise. | Low |

|

|||

| Reputation | Medium- to Long-term | If we fall behind on GHG reduction efforts, or if our initiatives and disclosures are seen as insufficient, our reputation with customers and investors could suffer. This could lead to lost business and make it harder to secure financing. | High |

|

||

| Physical | Acute | Short- to Long-term | The increasing severity of natural disasters due to climate change could damage our facilities and data centers, leading to higher costs for repairs and reconstruction. | Low |

|

|

| Short- to Long-term | If increasingly severe natural disasters damage our facilities or those of our suppliers, our operations could be disrupted or halted, resulting in a loss of revenue. | Medium |

|

|||

| Short- to Long-term | In the wake of severe natural disasters, corporate customers may prioritize restoring their damaged facilities, leading them to cut back on IT spending. | Low |

|

|||

| Chronic | Short- to Long-term | Rising average temperatures will drive up the cost of air conditioning needed to cool equipment at our facilities and data centers. | Low |

|

||

| Opportunity | Products and Services | Medium- to Long-term | IT spending is on the rise, driven by two key trends: a push toward paperless operations due to forest conservation policies, and the wider adoption of remote work in response to extreme weather. | Medium |

|

|

| Market | Short- to Long-term | Growing customer demand for decarbonization and resource-saving solutions presents an opportunity to develop new services and applications, creating new revenue streams. | Low |

|

||

| Short- to Long-term | As natural disasters become more severe, demand for cloud and data center services is rising as part of business continuity efforts. This, in turn, is driving sales for our related support services. | High |

|

|||

| Resilience | Short- to Medium-term | Taking proactive measures on climate change can enhance our reputation with customers and investors, potentially leading to more business and a higher stock price. | Low |

|

||

- Time Horizons: We classify the time horizons over which climate change risks and opportunities are expected to materialize as "short-term," "medium-term," and "long-term," defined as follows:

Short-term: By 2028; Medium-term: By 2030; Long-term: By 2050 - Impact Levels: We classify the level of impact from climate change risks and opportunities as "High," "Medium," or "Low" based on the following definitions:

High: Potential for a major impact on management due to significant fluctuations in business performance. Alternatively, a risk that a majority of employees could be unable to work and facilities rendered inoperable.

Medium: Potential for business operations to be impacted by fluctuations in business performance. Alternatively, a risk that around 30% of employees could be unable to work and facilities rendered inoperable.

Low: A minor impact on business performance with no significant effect on business operations. Alternatively, a risk that a portion of employees could be unable to work and facilities rendered inoperable.

Risk Management

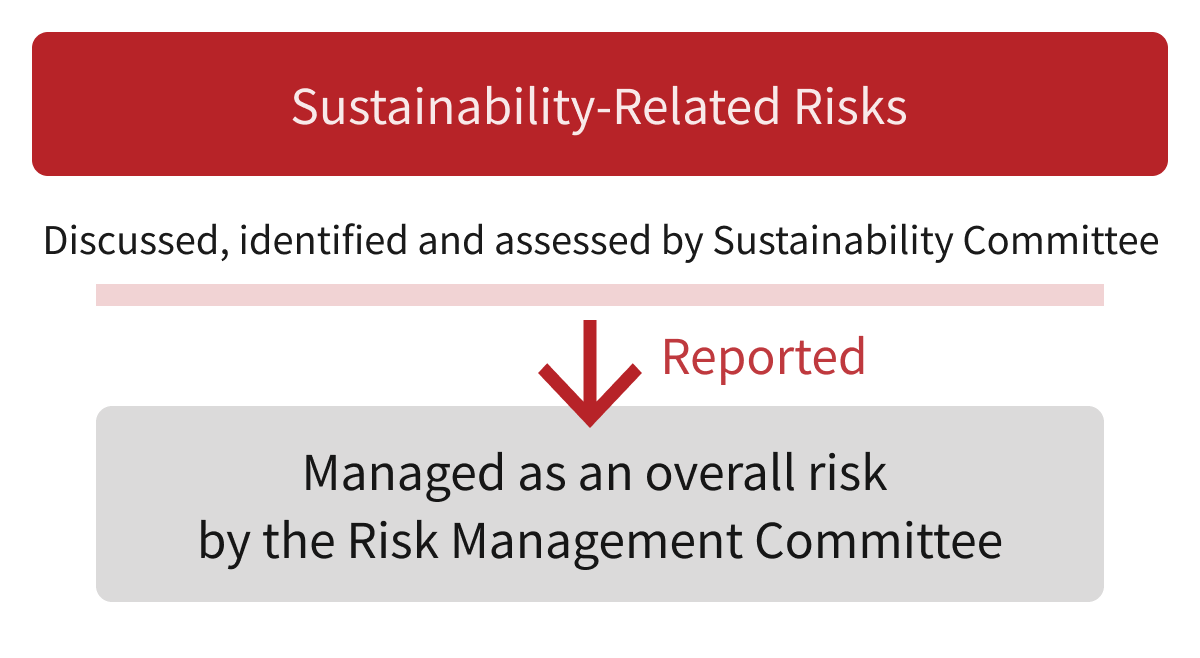

The System Support Group has a Sustainability Committee that discusses risks and opportunities related to sustainability, including climate change. Specifically, we identify and assess sustainability-related risks and opportunities by examining the impacts of the value chain both in the group as a whole and including suppliers and customers involved in Group businesses, as well as examining the value demanded by various stakeholders, such as investors and society.

Sustainability-related risks identified and assessed by the Sustainability Committee are also reported to the Risk Management Committee for company-wide risk management.

Metrics and Targets

To assess and manage the impact of climate change on our business, our Group began calculating our greenhouse gas emissions (Scope 1 and Scope 2) in accordance with the GHG Protocol, starting in the fiscal year ended June 2023. We have now also set a greenhouse gas emissions reduction target, as of July 2025. Moving forward, we will work to achieve this target by promoting various reduction initiatives, such as introducing renewable energy and thoroughly implementing energy conservation measures.

Greenhouse Gas Emissions Performance [Unit: t-CO2]

| FY2023 | FY2024 | |

|---|---|---|

| Scope 1 Emissions | 25 | 27 |

| Scope 2 Emissions | 311 | 314 |

| Scope 3 Emissions | - | 11,005 |

Greenhouse Gas Emissions Reduction Targets

| FY2030 | FY2050 | |

|---|---|---|

| Scope 1 + 2 Emissions | 42% reduction (compared to FY2023) | 100% reduction |

- Scope 1: Direct emissions from the consumption of city gas in our Group's offices and gasoline used in company vehicles.

Scope 2: Indirect emissions associated with the use of electricity and heat (for purposes such as air conditioning) at our Group's offices and facilities.

Scope 3: Indirect emissions related to our Group's business other than Scope 1 and Scope 2 (i.e., emissions from other companies). - We began calculating Scope 3 emissions starting with fiscal year 2024.

- Our Group compiles its greenhouse gas emissions data for the period from April of each year to March of the following year.

- At present, our Group's greenhouse gas emissions calculations have not undergone third-party verification.

- Regarding our greenhouse gas emissions reduction target for fiscal year 2050, we plan to utilize carbon credits to address any residual emissions remaining after all other reduction initiatives have been implemented.